Meet Madison Dearly

We offer top notch bookkeeping for brand and web designers who think big. Most importantly, we're here to make your numbers accessible and understandable. Curious about working with us? Come take a peek!

5 Ways Better Bookkeeping Can SAVE You Money

DOWNLOAD NOW

4 Xero Features That Make Bookkeeping So Much Easier

October 10, 2023

When it comes to keeping your books up to date, it’s all about choosing the best tools. And for most of us, that means accounting software. So…which one should you choose?

It’s no secret that I love Xero. It’s my favorite program to recommend to clients — and it’s what my team and I use here at Madison Dearly Bookkeeping too!

But even though I talk all the time about how much I love Xero, I haven’t given you a tour of my favorite features… until now!

That’s right, this is your chance to go behind the scenes with me and see some of the ways Xero can make your bookkeeping life easier. I’m covering four of my favorite Xero features and showing you how to get the most out of them!

So grab your laptop, get comfy, and let’s get started!

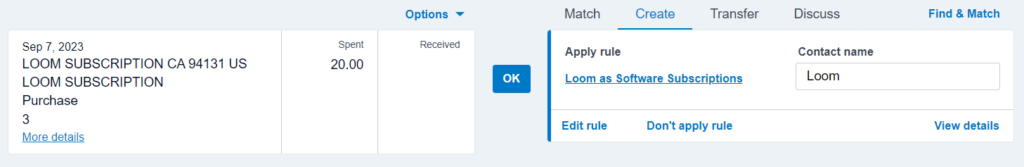

Xero Feature #1: Bank rules

First up, let’s look at bank rules. I know, it sounds boring (or maybe even a little intimidating), but don’t worry — you’re in charge of these rules! Basically, bank rules help automate the process of categorizing your transactions.

When you first get started with Xero, you’ll link your bank accounts in the software so it can start pulling in transactions. The next step is to set up some rules! That means telling Xero what it should do with certain types of transactions.

Once you have these rules set up, the software should start categorizing most of your transactions for you. Of course, it’s always a good idea to check and make sure Xero did it right. But in my experience, it does a great job as long as you set up the rules correctly.

Here’s an example: I told Xero that charges with “Loom” in the name should be categorized as software subscriptions. Now, the software does that for me — my Loom charges get pulled into the “software subscription” category of my business expenses.

And Xero also has a little bit of AI going on. Once you’ve categorized a few transactions (rules or no rules), it will try to categorize similar transactions for you. It doesn’t always get this right, of course, (so be sure to check for accuracy) but it does a pretty darn good job.

Just check every so often to make sure Xero is following the bank rules correctly. And trust me — doing those occasional checks takes way less time than categorizing all your transactions by hand!

Xero Feature #2: Stripe and PayPal integration

Here’s another thing I love about Xero — it’s besties with Stripe and PayPal. What does that mean for you? That everything’s set up for (pretty much) hands-off payment tracking.

When you get paid via Stripe or PayPal, that payment is basically three different transactions:

- The payment from your client to you

- The fee you pay to Stripe or PayPal

- The transfer from your Stripe/PayPal account to your business bank account

And you don’t want to forget about any of those steps in your books! If you leave one out, things can get confusing real fast.

But Xero has Stripe and PayPal integrations built right in! This means that it understands all those components of each transaction and records/categorizes them for you very easily!

So easy, so accurate — I’m obsessed!

And yeah, QuickBooks has integrations too, but I think Xero’s are so much better!

Xero Feature #3: Custom reporting

One of the things that’s most important to us here at Madison Dearly Bookkeeping is giving our clients reports that are actually useful. Not just some boring document filled with a bunch of accounting jargon — but beautiful, approachable reports that align with how clients actually think about the money in their business.

And — you guessed it — creating these personalized reports is a breeze with Xero. Just choose the aspects of your business finances that you want to know more about, and Xero will create a report that’s simple to understand.

What does that really mean for you? You’ve got the info you need to make those critical business decisions:

- Hiring a new team member

- Investing in a business opportunity

- Putting more money into marketing

- Raising your salary

All those decisions require you to know exactly what’s happening with your business finances. And with custom reports from Xero, you’ll have all that data at your fingertips.

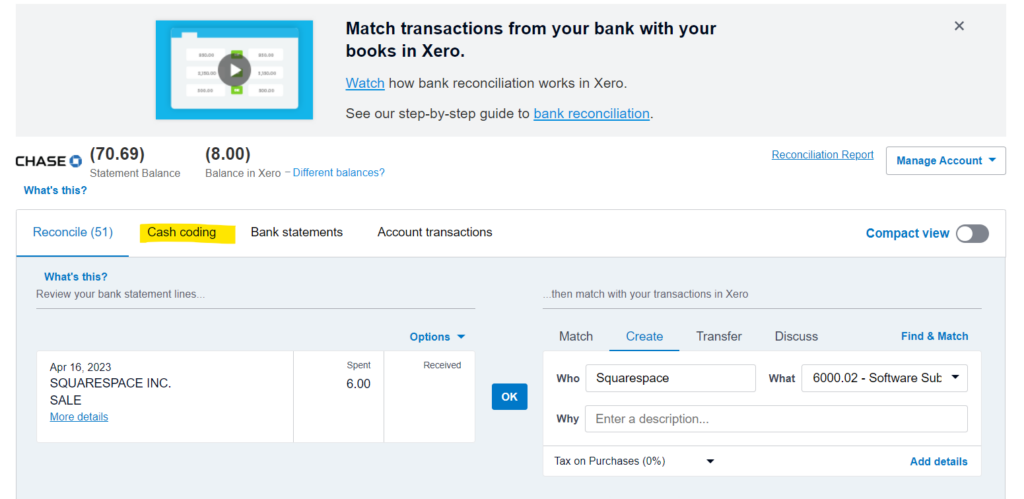

Xero Feature #4: Cash coding

Full disclosure: I’m gonna completely nerd out here. Because this is one of the coolest features of Xero, and I’m so excited to talk about it. And yes, you do need to upgrade to a higher tier of Xero to access this feature. But if your business has a lot of transactions, it’s so worth it!

OK, so what’s this awesome feature? Cash coding!

With cash coding, you can basically categorize all your transactions at once. That means every transaction from all of your bank feeds — analyzed, sorted, and categorized in one fell swoop.

Use the cash coding tool to search all of your bank feeds for certain transactions — like anything with a specific payee or description. Then categorize all of them at once, hit Reconcile, and…done. So legit! (If you want to see this in action, scroll up to the top of this blog post and watch the YouTube video!)

I love this feature so much, and it’s incredibly useful for anyone with lots of transactions. Do you sell templates or courses? Have lots of different items in your shop? This feature is gold.

Simplify your bookkeeping with Xero

I love taking care of all those bookkeeping tasks like categorizing transactions and creating reports — especially when I’m using Xero. It just makes everything so organized, simple, and quick.

It’s my favorite bookkeeping software — but you don’t have to be a professional bookkeeper to use it. In fact, it might be even more powerful for you DIY bookkeepers out there! Just take a few minutes to set up and link your accounts, set up your bank rules, and customize your reports — the software takes care of the rest!

I’ve got more tips on using Xero — plus tons of other practical tips on keeping your books — over on my YouTube channel! Head over there for everything you need to get (and keep) your business finances in shape!

Leave a Reply Cancel reply

Join The Monthly Book(keeping) Club

If you’re doing your bookkeeping yourself... AND PUTTING IT OFF for months at a time

JOIN THE CLUB

A done-with-you monthly bookkeeping membership for the online business owner who wants to learn how to do their business bookkeeping and actually get it done each month.

SITE CREDIT

Terms and Conditions

Privacy Policy

Want my best business finance tips delivered straight to your inbox? Join my email list here!

SUBSCRIBE

Madison Dearly Financial is the only comprehensive accounting firm exclusively serving creative small businesses.

Bookkeeping & Tax Services for CREATIVE PROFESSIONALS

PHOTOGRAPHY

Madison Dearly Financial is an independent firm and is not affiliated with, endorsed by, or officially associated with any accounting software platforms such as Xero, QuickBooks, or Gusto. All trademarks belong to their respective owners.

Pricing Note: Listed prices reflect base rates. Final pricing may vary based on the scope, complexity, and timeline of the project. Payment plans may be available upon approval.

Timeline Note: Estimated timelines are based on receiving timely client responses and smooth implementation. Projects with custom needs or delays may require additional time.

Content Disclaimer: Our blog content is for educational purposes only and does not replace professional financial, legal, or tax advice. We aim to keep information current and helpful—please consult a licensed expert before making decisions based on this content.

Paragraph

Paragraph

Home

About

Work With Us

Template Shop

Membership

Blog

Resources

Contact

Go ahead—

check us out!

We're an open book.

[…] savings, and credit card accounts all cozied up with Xero. This is simple to do right from your Dashboard in Xero. Simply enter your login information for each of your accounts (no personal accounts, only your […]