Meet Madison Dearly

We offer top notch bookkeeping for brand and web designers who think big. Most importantly, we're here to make your numbers accessible and understandable. Curious about working with us? Come take a peek!

5 Ways Better Bookkeeping Can SAVE You Money

DOWNLOAD NOW

Should You Save for That Big Purchase — or Can You Buy It Now?

January 31, 2023

This is one of the biggest questions we get from people: “How do I know if I can afford to invest in XYZ for my business?”

Whether it’s a part-time employee, an expensive piece of equipment, a conference, a mastermind… expenses will always come up in business. You know you need to invest in your business to grow, but is now the right time?

I’m sorry to say it, but without knowing your numbers, we can’t know the right answer. I can’t wave my magic bookkeeping wand and say, “You need to save $X!” or “You’ve got the cash, go for it!”

At least… I can’t. But you can. Want to learn how? It all starts with a little reflection and math (don’t leave just yet, it’s easy, I promise!).

Past, present, future

To really know if you can afford a big purchase or investment now or later, it helps to look at your business’s past, present, and future.

Your past.

What’s happened historically? Pull up your P&L (profit and loss) from your bookkeeping tool and take a look at your bottom line profit number across all of the months. Note which month you had the lowest profit, and also note the average profit across all of your months.

During your lowest profit month (preferably just over the past 12 months), would you have been able to afford this new investment while still saving for taxes and taking an owner’s draw? How about on average – would you have been able to afford it?

If you could comfortably invest in the past, you could probably do so now, too.

Don’t use a bookkeeping tool like Xero*? You can create a DIY bookkeeping spreadsheet. Check out my favorite one here!

Your present.

How are your cash reserves?

I am a huge believer in the Profit First method [link to bank accounts blog]. This method is a cash management system that allows you to look at separate bank accounts for your Operating Expenses, Tax Savings, Owner’s Pay, Income, and Profit.

Does the balance of your profit account cover the entire investment expense? If so, you might be able to afford it now.

Your future.

Do you know how much you have coming in (and going out) over the next three months? Write down all the invoices you will have coming due or getting paid over this time and sum it up by month!

Then write down all of your recurring expenses, like:

- Training & education (i.e. a group coaching program)

- Software

- Client Relationship Management (CRM) system (Dubsado or Honeybook, etc.)

- Zoom

- Loom

- G Suite

- Email marketing software (Flodesk or Convertkit, etc.)

- Zapier

- Social media scheduling software (Later.com or Planoly, etc.)

- Team members who are non-hourly with a fixed rate

Don’t forget to add your variable expenses, like:

- Stripe / PayPal fees

- Client gifting

- Team members who are hourly

Once you’ve got your total revenue and total expenses over the next three months, analyze what your profit will be and see if there is wiggle room for your big investment (after paying yourself and saving for taxes, of course).

If there is, you’re probably set. If you’re not sure… it’s probably time to work on a business budget.

Unsure if you can afford that new expense? That’s OK!

I know you want the quick-n-easy answer about whether you can invest or not, but if those first few exercises didn’t help you find the answer, it’s time to dig a little deeper. (Anyone else hear The Princess and the Frog in their heads now?)

If you’ve gone through the past few exercises and feel like maybe you need to save for your upcoming expense — or you definitely need to save for it — that’s actually good news. Instead of splurging on something and regretting it later when cash flow dips, you’re making smart decisions!

But how do you plan for a bigger investment? By starting a business budget.

Before you groan and exit out of this window, hear me out. A business budget isn’t the sexiest thing ever, but it can absolutely help you plan for and afford those new purchases or investments.

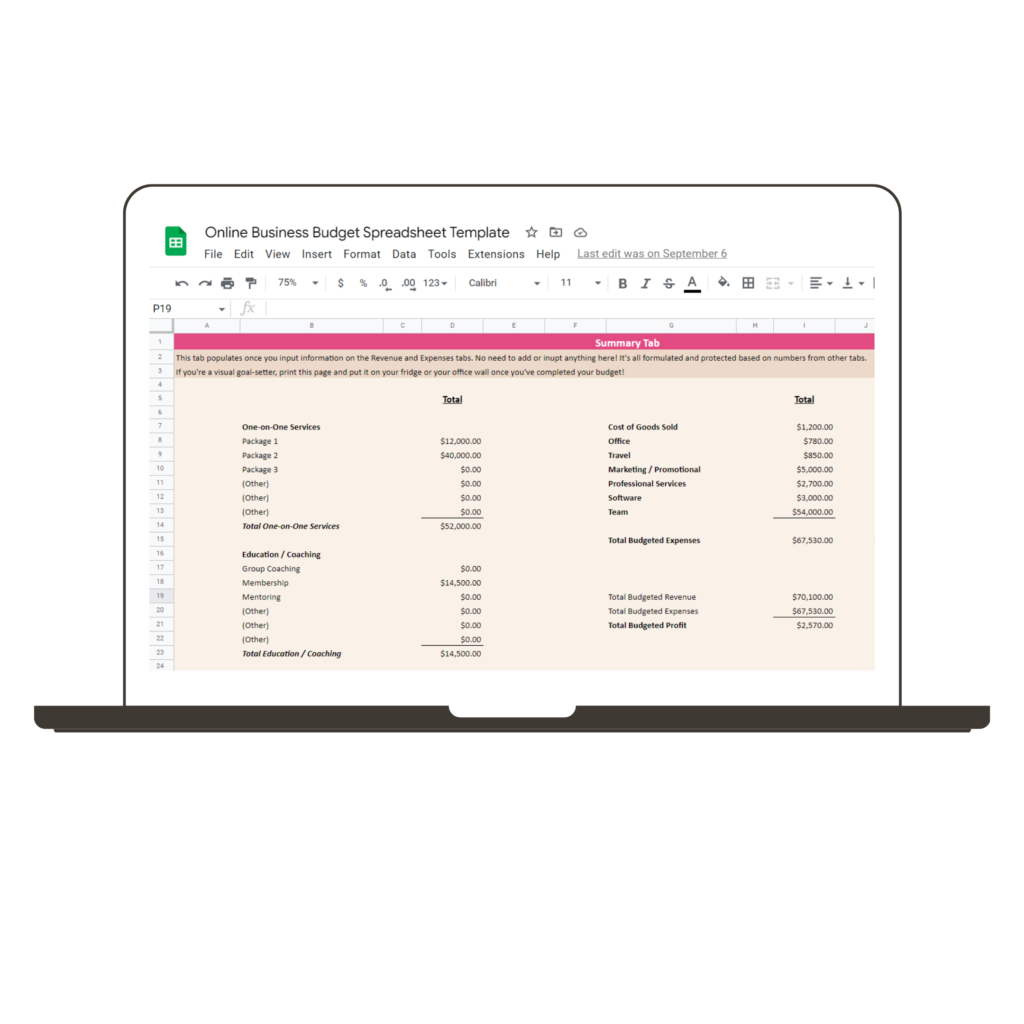

Plus, a business budget is a tool you can use to get out of the invoice-to-invoice hustle, so you have cash in the bank for a slow month or a new program. Instead of walking you through everything you should add to your DIY business budget, I want to show you my favorite tool in our Madison Dearly Bookkeeping Arsenal: Our Online Business Budget Spreadsheet.

This holy grail spreadsheet is a massive compilation of every single revenue stream and expense category from all of our clients. If you’re a brand + web designer (or any creative online business owner, really), chances are you have these same things on your financial reports, too.

The entire spreadsheet is broken down by month, so we can clearly map out what your revenue and expenses are for each month throughout the year. This helps TREMENDOUSLY when it comes to planning launches, taking time off in your business, and — yes! — figuring out if you can invest in a new purchase or team member.

The real magic comes from tracking your revenue, though. Instead of just saying, “I bring in $X a month,” the revenue tab has room for 1:1 services, education and coaching offers, and digital product sales. Because I know that, as a creative entrepreneur, you’re creative about your revenue streams!

The expense tab covers every single thing you could think of when it comes to money going out of your business: office supplies, travel expenses, marketing / promotional, professional services (legal + CPA), software subscriptions and room for every one of your team members!

Best of all? This budget spreadsheet is SIMPLE and easy to set up. I’ll give you a video tutorial that walks you through everything so you can have this girlie set up in no time.

It’s time to see exactly what’s happening with your business finances, so you can plan for more growth and investments. It’s all up from here!

Download this Online Business Budget Spreadsheet Template for just $97.

Just imagine — you can spend $97 now and stop wasting money on expenses that aren’t working for you and your business. What a dream, right?

Plus, no more DIY spreadsheets that make you want to scream. I’ve covered all the revenue streams and expenses a creative biz owner could possibly think of so you don’t have to.

You in? Grab your business budget template here.

Leave a Reply Cancel reply

Join The Monthly Book(keeping) Club

If you’re doing your bookkeeping yourself... AND PUTTING IT OFF for months at a time

JOIN THE CLUB

A done-with-you monthly bookkeeping membership for the online business owner who wants to learn how to do their business bookkeeping and actually get it done each month.

SITE CREDIT

Terms and Conditions

Privacy Policy

Want my best business finance tips delivered straight to your inbox? Join my email list here!

SUBSCRIBE

Madison Dearly Financial is the only comprehensive accounting firm exclusively serving creative small businesses.

Bookkeeping & Tax Services for CREATIVE PROFESSIONALS

PHOTOGRAPHY

Madison Dearly Financial is an independent firm and is not affiliated with, endorsed by, or officially associated with any accounting software platforms such as Xero, QuickBooks, or Gusto. All trademarks belong to their respective owners.

Pricing Note: Listed prices reflect base rates. Final pricing may vary based on the scope, complexity, and timeline of the project. Payment plans may be available upon approval.

Timeline Note: Estimated timelines are based on receiving timely client responses and smooth implementation. Projects with custom needs or delays may require additional time.

Content Disclaimer: Our blog content is for educational purposes only and does not replace professional financial, legal, or tax advice. We aim to keep information current and helpful—please consult a licensed expert before making decisions based on this content.

Paragraph

Paragraph

Home

About

Work With Us

Template Shop

Membership

Blog

Resources

Contact

Go ahead—

check us out!

We're an open book.

[…] same applies to your business, too. If you don’t have the cash on hand for something, you should probably pause on it until you do. But… how do you actually plan for a large business […]