Meet Madison Dearly

We offer top notch bookkeeping for brand and web designers who think big. Most importantly, we're here to make your numbers accessible and understandable. Curious about working with us? Come take a peek!

5 Ways Better Bookkeeping Can SAVE You Money

DOWNLOAD NOW

Planning for a Large Business Purchase: What to Know

February 6, 2023

Think about the last time you wanted something in your personal life. Maybe it was a new brand-name bag, a new TV, or a new couch.

These things aren’t just chump change — they’re pretty expensive. I don’t know about you, but I don’t just have extra thousands of dollars lying around. All my money has a job. So if I want something new, I have to save for it.

The same applies to your business, too. If you don’t have the cash on hand for something, you should probably pause on it until you do. But… how do you actually plan for a large business purchase? What should you take into account?

I’m going to dig into all of that so you can confidently make that big business purchase one day! Let’s go.

First, focus on what you’re buying

Let’s say you need to buy a new laptop because yours is from 2012 and you’re now realizing that is geriatric in the world of tech. But laptops have gotten way more expensive over the last decade! So you know you need to save up for this.

First, look at what your desired purchase is going to cost. In the case of a new laptop, a top-of-the-line one might cost $2,800 shipped to your door.

If you’re planning for another big purchase or investment, like a brand re-design or a new product, you’ll need to do the math.

What does it actually cost — in straight numbers? A re-design might cost $3,500. A new product might cost just a couple bucks to make (a template purchase or a better delivery system).

But what are the variable costs? A re-design might be $3,500, but if you need a new website to reflect the re-brand, your price might go up to $5,000.

A new product launch isn’t just the cost of making the product, it’s the cost of promoting it. You might need a copywriter, a landing page designer, social media templates to promote it, an ads manager, or even a new email system so you can manage leads and deliver your product. That takes you from a couple bucks to a couple thousand. (More on this math in just a bit.)

Before you decide how much something will cost you, look at all the pieces. Even a new laptop isn’t “just” $2,800. You might need a new case, insurance, new software, new headphones or chargers, etc.

Next, look at the return on investment

Part of planning for a big purchase is also planning for the return that purchase will get you. We don’t usually purchase things “just for fun” in business, like we do in our personal lives. So when you look at the cost of your upcoming purchase, also look at the ROI.

ROI of technology

For example, that laptop. It’s $2,800+, but what’s the return on that investment? You’ll be able to work on the go, you’ll be able to work faster, and you’ll be able to download new software that allows you to serve your clients better. While we can’t project exactly how much that costs, it’s clear that there is an ROI.

ROI of programs and courses

On the other hand, let’s look at another big purchase that business owners save for: Masterminds and courses. Some masterminds are very expensive — multiple thousands a year. Let’s say you want to join a mastermind that is $10,000 a year. What’s the ROI on that? Again, this is hard to calculate.

My recommendation, when you’re looking to make a purchase with an ROI that’s unclear, is to make a plan for how this big purchase will change your business. Are you wanting more leads? More email subscribers? A technique or process that you’re learning from the educator that will help you create more sales? Put a CLEAR plan in place for the outcome of this investment and track each of those KPIs individually and consistently.

ROI of launches

For launches, you should also really look at your projections. This will help determine your budget, too! Instead of saying, “I want a 6-figure launch!” really look at how much you want to make, how many products you have to sell to make that happen, and then back that into how much you need to spend.

For example, if you want to sell $10,000 in your new product that costs $97, that’s about 103 purchases. To get 103 purchases, you need to have about 1,000 people view your sales page (based on an average 10% conversion rate). And to get 1,000 people to view your sales page, you need to reach about 11,000 people (based on an average Facebook ad click-through rate of 0.9%).

That helps you understand how much you’ll need to spend on ads to reach that many people (hopefully of your target audience). It also shows you how many people you’ll need to get on your landing page from other mediums, like organic social media, email, etc. All of this guides how much you spend.

Again, it helps to get clear on the ROI so you can see how much it’s really worth to pour into something. It also helps you calculate a more realistic number than just the “fixed costs.”

Lastly, determine when you’ll have the cash on hand

One of the most common refrains I hear from small online business owners is, “I’ll put it on my credit card,” or “Oh I’ll just dip into the business savings for this.” In some cases — like when you need to hire someone stat or a totally unbelievable discount is being offered — I get it. But for the most part, I want you to have the cash on hand to pay for your next big business purchase.

To do this, I like to look at your past, present, and future. No, not in like a clairvoyant psychic medium way. In a money way.

Past

Could you have afforded this purchase in the past? Did you have the cash leftover each month from your fixed expenses to easily fit this in?

For example, I wanted to hire a content team in 2022 — but I knew that, based on my 2021 revenue, it wasn’t in the cards. But in 2022, we made enough to comfortably fit in that expense. So when I hired my content team in 2023, I knew that (at least for most months) I could comfortably fit this expense.

If you couldn’t comfortably pay for your upcoming purchase or project from monthly revenue last year, you’ll want to set aside money each month until you can pay for it that way! No need to dip into cash flow and risk eating into other accounts.

Present

As of right now, do you have the extra cash to pay for this thing? No, I’m not saying cash period. I don’t want you to buy something that puts your bank account balance at $0. I’m really looking at the “supplemental cash” that you have as a cushion in your bank account. Not your tax savings account, not money you’re supposed to pay yourself with. Extra cash on hand.

If not, it’s time to start saving!

Future

Do you have some big projects lined up that are already signed for and paid? Do you know you’ll have extra cash coming in over the next few months? That may be a good time to make this purchase, when you have the extra income.

It’s time to create a business budget

As you went through the exercises above, did you realize that you can actually afford the purchase or investment you’ve been considering? That’s a big ol’ “heck yes!!” for you. But if you’re realizing that you need to plan for and save money to purchase your “new thing,” that’s also a “heck yes!!” because it’s clear.

I’d rather you realize now that you need to save before your purchase because that means you can plan it and feel really good about making that investment when you’re ready. It’s no fun to buy something or start a project only to realize that it wasn’t the right time for you financially.

Need help planning for your upcoming business purchases or investments? I have something that can help.

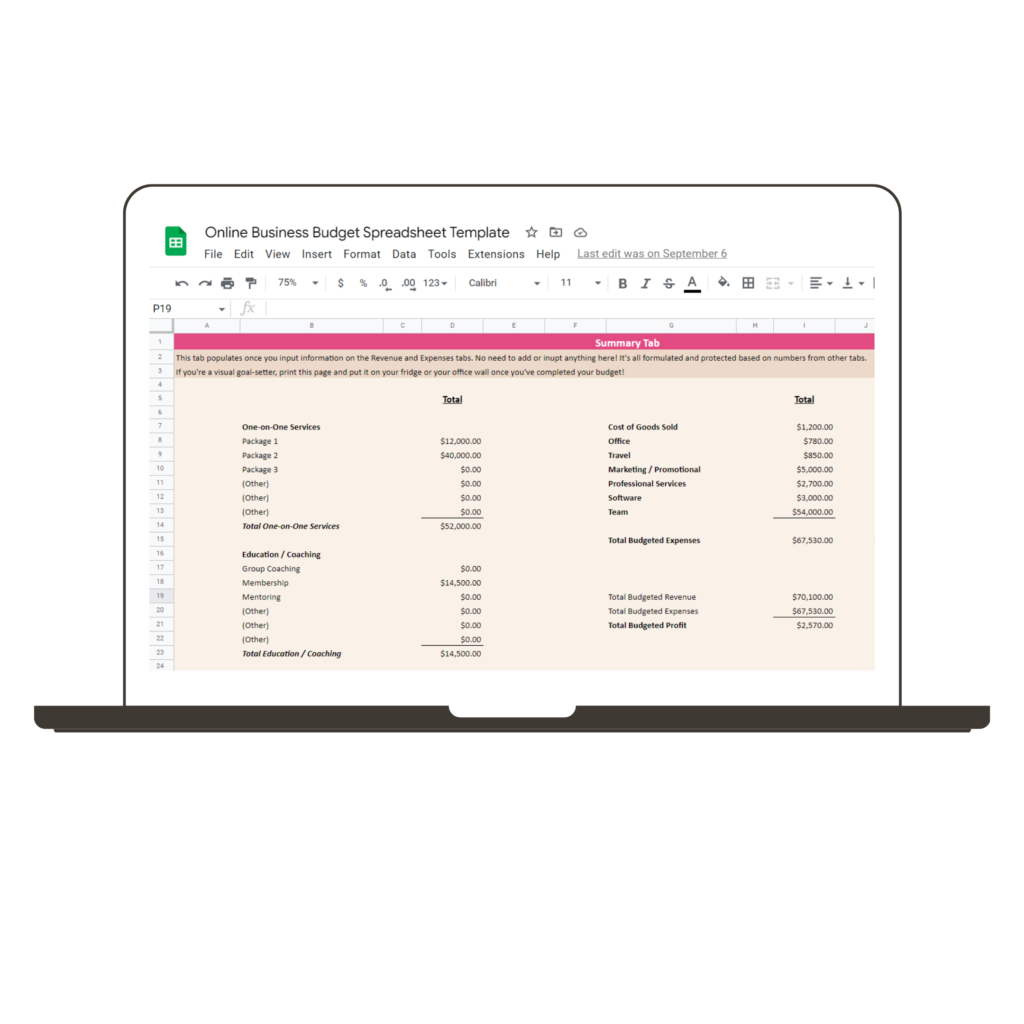

Meet my new Online Business Budgeting Spreadsheet!

Instead of making “gut check” decisions about your finances or wondering if you can afford that big purchase, you’ll know. And if you can’t afford something just yet, this spreadsheet will help you set a goal, track it, and save for those big investments.

This template makes it SO EASY to:

? Plug in your numbers

? List out all your expenses

? Detail your income (based on revenue streams)

? See what cash you actually have to spend

If you’re looking at investing in a new program, mastermind, tech, or even team member — or you want to stop waiting for invoices to get paid so you can pay yourself — you’ll want to check out this budgeting spreadsheet.

For just $97, you get:

- A Google Sheets version of the template (easy to download for Excel, too!)

- A tab for expenses (almost every expense you could imagine)

- A tab for revenue (including all the different ways you might make money)

- A simple way to look at your money, month by month

- A video tutorial with how to customize for your needs

All you have to do is make a copy of the template, watch the quick tutorial, and start plugging in your numbers.

Ready to plan for your purchases and make more confident decisions with your business’s finances? Grab the Online Business Budgeting Spreadsheet for just $97!

Leave a Reply Cancel reply

Join The Monthly Book(keeping) Club

If you’re doing your bookkeeping yourself... AND PUTTING IT OFF for months at a time

JOIN THE CLUB

A done-with-you monthly bookkeeping membership for the online business owner who wants to learn how to do their business bookkeeping and actually get it done each month.

SITE CREDIT

Terms and Conditions

Privacy Policy

Want my best business finance tips delivered straight to your inbox? Join my email list here!

SUBSCRIBE

Madison Dearly Financial is the only comprehensive accounting firm exclusively serving creative small businesses.

Bookkeeping & Tax Services for CREATIVE PROFESSIONALS

PHOTOGRAPHY

Madison Dearly Financial is an independent firm and is not affiliated with, endorsed by, or officially associated with any accounting software platforms such as Xero, QuickBooks, or Gusto. All trademarks belong to their respective owners.

Pricing Note: Listed prices reflect base rates. Final pricing may vary based on the scope, complexity, and timeline of the project. Payment plans may be available upon approval.

Timeline Note: Estimated timelines are based on receiving timely client responses and smooth implementation. Projects with custom needs or delays may require additional time.

Content Disclaimer: Our blog content is for educational purposes only and does not replace professional financial, legal, or tax advice. We aim to keep information current and helpful—please consult a licensed expert before making decisions based on this content.

Paragraph

Paragraph

Home

About

Work With Us

Template Shop

Membership

Blog

Resources

Contact

Go ahead—

check us out!

We're an open book.

[…] nearly as fun as revenue, but expenses are just as important. Every time you spend money on your business, that’s an expense. Buying office supplies, paying for software subscriptions, getting a new work […]

[…] IRS has rules for what you can claim as a business expense. And they’re not as complicated as you might think. You can expense purchases that are ordinary […]

[…] once you know what you’re planning, you can figure out the finances. Ideally, you’ll want to save up all the money you need to cover your expenses while you’re out. Another option is to dip into your business’s […]

[…] once you know what you’re planning, you can figure out the finances. Ideally, you’ll want to save up all the money you need to cover your expenses while you’re out. Another option is to dip into your business’s […]