Meet Madison Dearly

We offer top notch bookkeeping for brand and web designers who think big. Most importantly, we're here to make your numbers accessible and understandable. Curious about working with us? Come take a peek!

5 Ways Better Bookkeeping Can SAVE You Money

DOWNLOAD NOW

Business Budget Basics for Online Business Owners

February 28, 2023

What’s your revenue target for the year? Will it be enough to expand your team so you can take on more clients? What about giving yourself a raise? Or covering that new office chair? To answer those questions, you need a business budget.

Without a budget, you don’t have a clear picture of your expenses. This means you can’t know how much revenue you need to bring in to make the kind of profit you want!

Creating a business budget doesn’t have to be as complicated as it seems. I’ve got an easy step-by-step system to get you up-to-date on your books and ready to build (and follow) a realistic budget.

Business budget step 1: Update your books

Yep, your friendly bookkeeper here! ? Of course this is where we’re starting!

But seriously — you can’t know how to plan for upcoming income and expenses if you have no idea what your current numbers look like. Seeing your past expenses gives you a good idea of what your future costs will be.

How much are you really spending on software subscriptions? Or making from your 1:1 coaching each month? And when will you finally be able to afford to join a mastermind or upgrade your website?

You won’t know until you get your books up to date (and by up to date, I mean January 1 until today!) Make sure you have every transaction from your bank account(s) organized by type — income, contract labor, professional dues, expenses, etc.

If you have never sorted your transactions like this, let’s start now. There are lots of options when it comes to managing your books. You’ve got software, spreadsheets, and even an old-school ledger. Here are my favorites:

Spreadsheet

Want to track your transactions in a spreadsheet? This is a great DIY option that doesn’t require you to buy and learn accounting software. Your two basic options are Google Sheets and Excel — either one is great!

Need a template for tracking your income, expenses, and profit? I love Elizabeth McCravy’s Bookkeeping Spreadsheet!

Software

There are lots of options out there for accounting software. If you’re just starting out in your business (or just starting your bookkeeping tasks), go with something simple. You don’t want to kill your new-found motivation because the software is just too complicated. Simply set up an account, connect your bank, and start sorting through transactions.

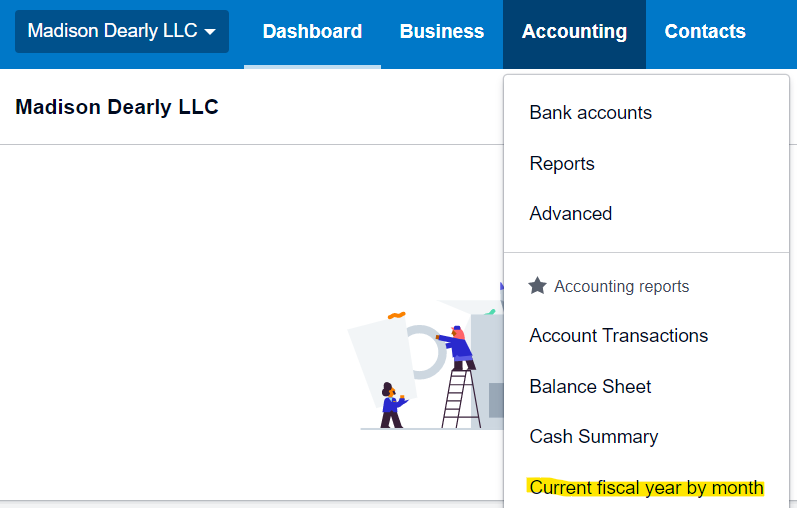

I really like Xero. You can start for just $12 a month and then get an upgrade as your business grows. (Spoiler alert: none of my clients have ever needed to pay more than the $12 per month subscription level, because that’s really all you need!)

Outsourcing

If the latest software or simplest spreadsheet just isn’t going to motivate you to get in there and do your bookkeeping, that’s OK! You have plenty of other things to handle in your business, so hire an expert (hi!) to do your books.

Step 2: Pull a P&L

Now that your books are up to date with your past and current financial transactions, it’s time to build a template for this or next year’s budget. And that template comes in the form of a P&L report.

Yep, that’s profit & loss — basically a summary of all those revenue and expenses numbers you put in your books. Any accounting software should allow you to pull a P&L, and we’re looking for the monthly report here.

Why do we need a P&L?

Two reasons:

- It’s a “shell” for your new budget that includes all the typical categories for your revenue and expenses.

- It gives you approximate numbers for all those expenses, so you have an idea of what your future spending will look like.

So, if you’re using accounting software, run your P&L by month and export it into a spreadsheet. Then, erase all those current numbers but keep the format — that’s what you’ll use to build your budget.

If you’re not using software, then just start with your spreadsheet. Make a copy of it and erase all the numbers so you have a place to start adding in all of your budget numbers.

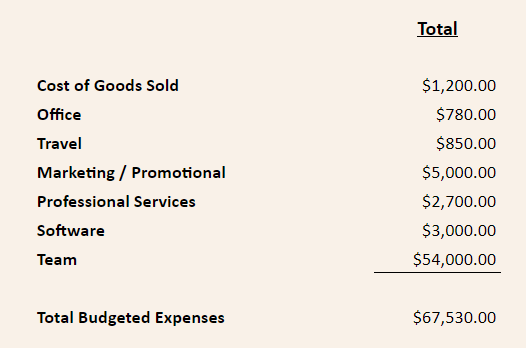

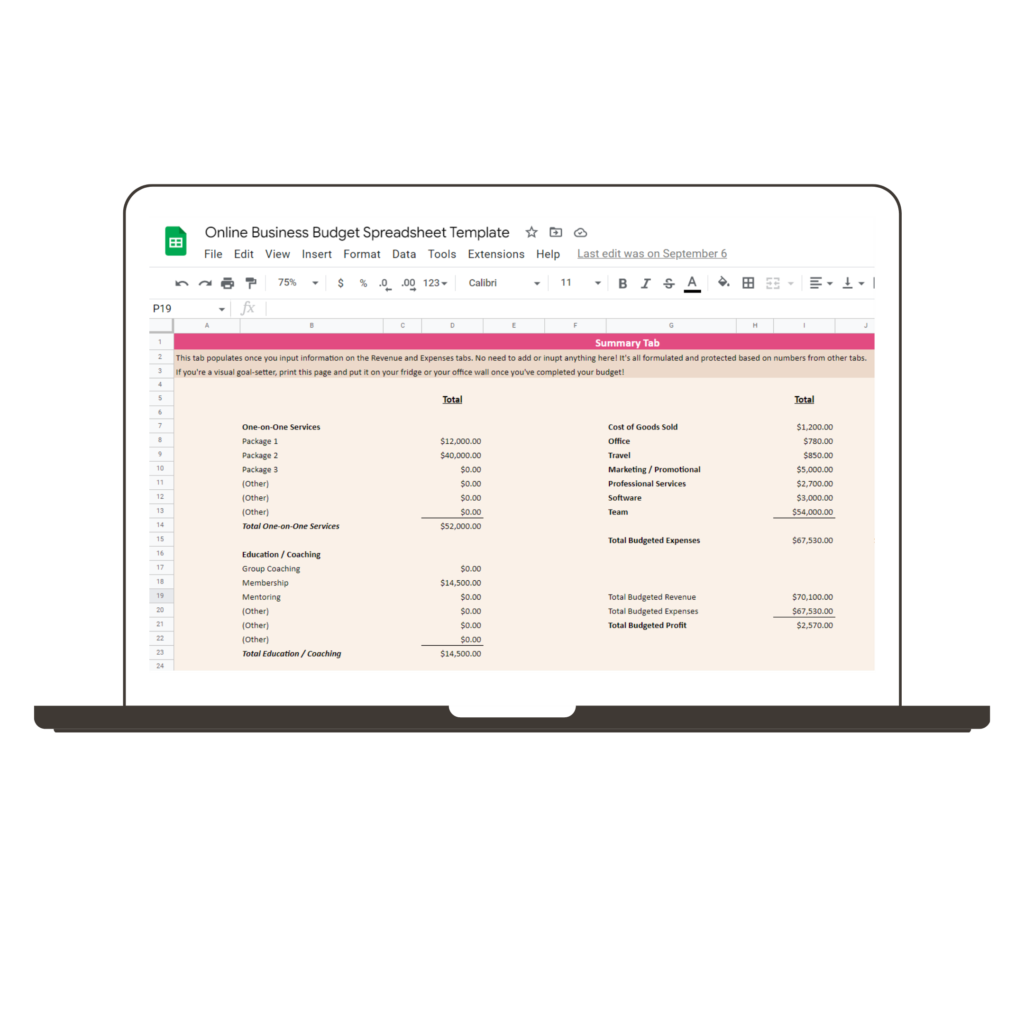

Don’t want to build your own spreadsheet template? Skip this step completely and grab my Online Business Budgeting Spreadsheet. It’s got all the revenue and expense categories you could think of, plus room for customization. Get it here!

Step 3: Take care of the bills first!

You’re all set to plan out this (or next) year’s budget. You’ve got the data you need from your past transactions and this current year, and you can use that to get a general idea of your spending for the coming year.

Start putting in past expenses and any new ones for this year — everything you can think of:

- All monthly expenses from your existing P&L

- Any new expenses you anticipate for next year

- Pay increases

- New hires

- Office expenses

- Software subscriptions (and make sure all of them are programs you actually use!)

- Professional development (like courses and masterminds)

- Client gifts

- Yearly expenses (like paying your CPA to file your taxes)

Now that you’ve got all your expected expenses down, it’s wishlist time! In the spreadsheet template you’re making, add in all the fun things you want to be able to afford. We’re talking business trips, in-person conferences, courses, experts (like a brand photographer), and any other fun things you want for your business next year.

Step 4: Set a sales goal

With all your monthly expenses in your budget, you can now figure out your sales goals. You’re going to “back in” to those numbers using all the info from your budget template.

How do you calculate your revenue goal? Think about it this way. You need to make at least enough money to cover your expenses — and hopefully those wishlist items too! If all those expenses add up to $100,000, you need to bring in at least $100k just to pay those bills.

But you want to do more than just pay your bills! Let’s say you also want to bring home $100,000. That makes your revenue goal $200,000!

Ooh, but what about taxes? You can expect to pay about 30% of your profit in taxes. So $30,000 of your $100,000 profit is going to the IRS, which means you’re now taking home $70,000.

So how much do you actually need to make (revenue) if you want to bring home $100,000? Drumroll, please. . .

$250,000!

Here’s why:

- Revenue: $250,000

- Expenses: $100,000

- Profit = revenue – expenses: $150,000

- Taxes: $45,000

- Take-home pay: $105,000

So, if you want to pay yourself $100,000, you need to actually bring in $250,000 of revenue! That works out to about $20,850 per month. So, for example, if your signature service offer is $4,500, then you need five of those clients each month to reach your revenue goal! Talk about clarity!

It would be almost impossible to know that without a budget. But with that template you created, it’s easy to see exactly what you need to do to reach your goals.

And now you can use this method every year in your business. As long as you know your expenses and your wishlist items, you can calculate your revenue goals.

Oh, and planning for some time off in the future? You could put that in your budget too!

Creating a realistic business budget

If you’re like most entrepreneurs and business owners I know, you’re not exactly a lover of spreadsheets or numbers. Even if you’re comfortable with your numbers, tracking them and figuring out things like formulas, conditional formatting, and all that is just… too much.

You’re busy — and you want to budget. What’s a business owner to do? Grab our NEW Online Business Budgeting Spreadsheet.

The entire spreadsheet is broken down by month, so we can clearly map out what your revenue and expenses are for each month throughout the year. This helps tremendously when it comes to planning launches, taking time off in your business, and adding extra expenses into months where revenue is higher to keep your profitability in check!

This budgeting spreadsheet is easy to understand, and SIMPLE. Because who else needs a complicated, “Is this SUM formula working right?!” type of spreadsheet in their lives? Not you.

I’ve even included a mini-training walkthrough video to show you EXACTLY how to use the spreadsheet, so there’s no guessing on how to use this thang to its full potential.

Want to see the spreadsheet in action? Check it out here.

Leave a Reply Cancel reply

Join The Monthly Book(keeping) Club

If you’re doing your bookkeeping yourself... AND PUTTING IT OFF for months at a time

JOIN THE CLUB

A done-with-you monthly bookkeeping membership for the online business owner who wants to learn how to do their business bookkeeping and actually get it done each month.

SITE CREDIT

Terms and Conditions

Privacy Policy

Want my best business finance tips delivered straight to your inbox? Join my email list here!

SUBSCRIBE

Madison Dearly Financial is the only comprehensive accounting firm exclusively serving creative small businesses.

Bookkeeping & Tax Services for CREATIVE PROFESSIONALS

PHOTOGRAPHY

Madison Dearly Financial is an independent firm and is not affiliated with, endorsed by, or officially associated with any accounting software platforms such as Xero, QuickBooks, or Gusto. All trademarks belong to their respective owners.

Pricing Note: Listed prices reflect base rates. Final pricing may vary based on the scope, complexity, and timeline of the project. Payment plans may be available upon approval.

Timeline Note: Estimated timelines are based on receiving timely client responses and smooth implementation. Projects with custom needs or delays may require additional time.

Content Disclaimer: Our blog content is for educational purposes only and does not replace professional financial, legal, or tax advice. We aim to keep information current and helpful—please consult a licensed expert before making decisions based on this content.

Paragraph

Paragraph

Home

About

Work With Us

Template Shop

Membership

Blog

Resources

Contact

Go ahead—

check us out!

We're an open book.