Meet Madison Dearly

We offer top notch bookkeeping for brand and web designers who think big. Most importantly, we're here to make your numbers accessible and understandable. Curious about working with us? Come take a peek!

5 Ways Better Bookkeeping Can SAVE You Money

DOWNLOAD NOW

Payroll Vs. Bookkeeping: Which One Do You Need for Your Online Business?

September 5, 2023

*This blog contains affiliate links. While we do earn a small commission if you use our link, the price doesn’t change for you. Also, we only recommend products and services we love!*

When it comes to the financial side of running an online business, there are TONS of terms thrown around — CPA, accountant, bookkeeper, taxes, payroll…the IRS, for example.

And if you’re new to business, have yet to hire an employee, or you’re just someone with experience and no love of numbers (it’s okay, I forgive you), then all these words start to blend together at some point, don’t they?

(Except for Uncle Sam — he’ll never let you forget who he is.)

Part of my goal here at Madison Dearly Bookkeeping is to break down all that financial stuff so it’s much easier for you to keep your books in order. And that’s why today, we’re going to take a look at payroll vs. bookkeeping, and which one you actually need for your business.

Let’s define payroll and bookkeeping

When I say “payroll vs./or bookkeeping” what I really mean is AND — payroll AND bookkeeping. Because these two are not the same thing, but payroll can be included in bookkeeping.

Still, they each have their own purposes, so let’s break them down!

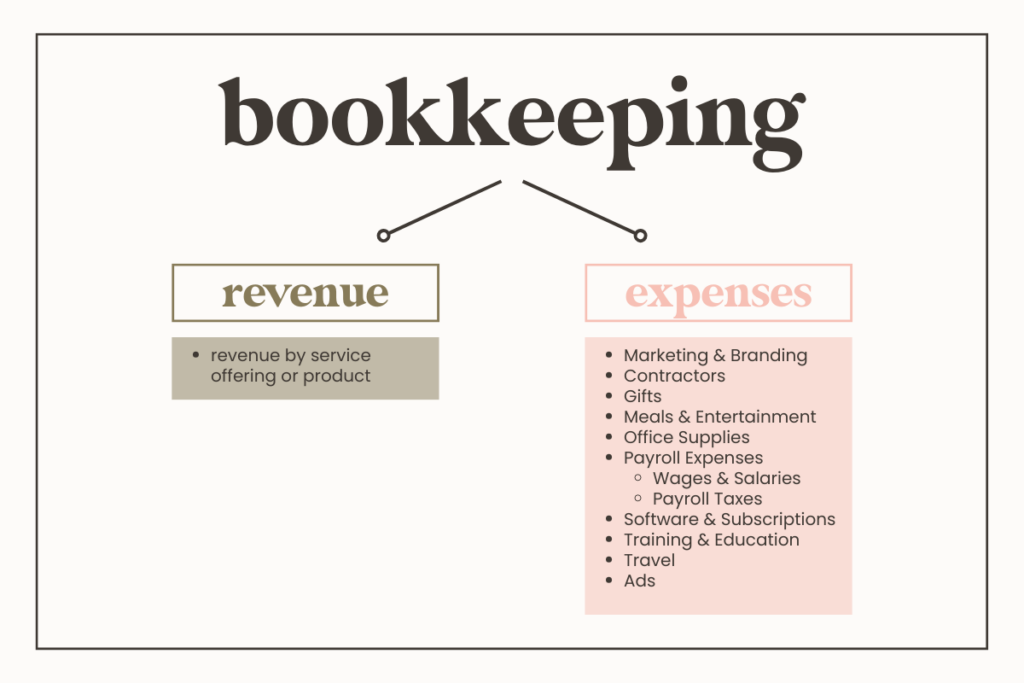

What’s bookkeeping?

Bookkeeping is accounting. It involves monitoring every transaction that comes in, and every one that goes out. If you work with a bookkeeper, they’ll compile a financial report to show the flow of your money so you can keep better tabs on what it’s really up to.

We do things like create profit and loss reports, reconcile bank accounts, manage bank feeds…things like that. That’s the gist of it.

What’s payroll?

Payroll, on the other hand, is the process of paying your employees on a set schedule throughout the year. And because bookkeeping exists to monitor transactions like these, payroll falls under the umbrella term of bookkeeping.

This is also where employers (that’s you, business owners!) withhold payroll taxes and send them to the government on behalf of an employee (whereas freelancers/contractors would do this themselves).

The benefit for the employee is that the employer takes on part of those taxes, so the employee doesn’t have to pay the full amount. You BOTH pay taxes for that employee.

Payroll also includes things like sick time, PTO, and benefits or reimbursements.

How payroll and bookkeeping interact with each other

Like I said, payroll is a part of bookkeeping. So, naturally, they’re going to work together in your business.

Payroll will flow into your bookkeeping reports as an expense paid. But you need to make sure that when it does, it’s separated out by category and expenses. Don’t just lump the taxes and salary as one line item (trust me, it WILL get confusing!).

You need to be able to see what’s really going to employees, what you’re paying, and what’s going to the government. That way, if you ever want to do something like increase an employee’s pay, or want to make a new hire in the future, you can see what’s actually going to their pocket and make salary adjustments as needed.

So…when do you need to worry about payroll?

When should you focus on payroll? Well, it depends.

Everyone has to do bookkeeping — it’s a non-negotiable! If you’re getting paid and spending money to provide products or services, then you need bookkeeping. It doesn’t matter if you keep track of it or not. Bookkeeping just is.

But you won’t need payroll if you don’t have employees. If you have a team of independent contractors or freelancers, you’ll send them a 1099 form when it’s tax season, and they are then in charge of paying their own taxes. You just pay them their rate. (Contractors dictate their own charges/fees, whereas in the employer-employee relationship, the employer sets the rate.)

And when you add employees to your online business, that’s when payroll becomes a necessity (because people want to get paid…and you don’t want any trouble from the IRS!).

Is your head spinning? Try Gusto!

A final note about payroll and bookkeeping? Don’t try to do it manually.

I know this is a lot of information to take in, and you’re probably thinking, “One more thing for me to worry about? BRB, gonna cry.”

But don’t fret! You don’t HAVE to do this all by hand. This isn’t your 10th-grade calculus homework from 2005. Tech has come a looonnngg way since then, and there are so many resources available now for online business owners to simplify their books.

Ya know…without all the chicken scratch notes and back peddling when you forgot a number. It’s WAY better these days.

Take Gusto, for example. They’re a payroll software I love just about as much as I love Xero (and that’s like…a whole lot). They make it easy peasy to enter information about what you need for payroll — like salary per employee and tax laws by state.

It’s seriously just about as easy as payroll gets because it’s all automated.

Automated payroll? Yes please!!! If you wanna see what all the fuss about Gusto is about, then you can learn more here.

And if you really really do NOT want to DIY it, we’ve got you covered.

Leave a Reply Cancel reply

Join The Monthly Book(keeping) Club

If you’re doing your bookkeeping yourself... AND PUTTING IT OFF for months at a time

JOIN THE CLUB

A done-with-you monthly bookkeeping membership for the online business owner who wants to learn how to do their business bookkeeping and actually get it done each month.

SITE CREDIT

Terms and Conditions

Privacy Policy

Want my best business finance tips delivered straight to your inbox? Join my email list here!

SUBSCRIBE

Madison Dearly Financial is the only comprehensive accounting firm exclusively serving creative small businesses.

Bookkeeping & Tax Services for CREATIVE PROFESSIONALS

PHOTOGRAPHY

Madison Dearly Financial is an independent firm and is not affiliated with, endorsed by, or officially associated with any accounting software platforms such as Xero, QuickBooks, or Gusto. All trademarks belong to their respective owners.

Pricing Note: Listed prices reflect base rates. Final pricing may vary based on the scope, complexity, and timeline of the project. Payment plans may be available upon approval.

Timeline Note: Estimated timelines are based on receiving timely client responses and smooth implementation. Projects with custom needs or delays may require additional time.

Content Disclaimer: Our blog content is for educational purposes only and does not replace professional financial, legal, or tax advice. We aim to keep information current and helpful—please consult a licensed expert before making decisions based on this content.

Paragraph

Paragraph

Home

About

Work With Us

Template Shop

Membership

Blog

Resources

Contact

Go ahead—

check us out!

We're an open book.