Meet Madison Dearly

We offer top notch bookkeeping for brand and web designers who think big. Most importantly, we're here to make your numbers accessible and understandable. Curious about working with us? Come take a peek!

5 Ways Better Bookkeeping Can SAVE You Money

DOWNLOAD NOW

5 Bookkeeping Habits to Build

October 31, 2023

Picture your house for a moment. The routines you follow, like unloading the dishwasher in the morning or doing a daily load of laundry from start to finish (goals, amirite?!), keep things organized and make life run more smoothly. Now, think about your business; it’s like a home for your finances. In this blog post, we’re going to discuss the five essential bookkeeping habits that are like the secret sauce to maintaining the zen in your financial household. These habits are the key to ensuring your business doesn’t turn into a cluttered, chaotic mess. So, grab a comfy seat and join us as we create some serious peace in your financial living room!

Habit 1: Daily Awareness

The first habit is about cultivating daily awareness of your spending. In a world where we’re constantly bombarded with sales pitches, it’s easy to give in to impulse purchases.

To combat this, make it a practice to sleep on potential purchases for 24 hours. Talk about it with a trusted friend (or me, your bookkeeping big sis), and check your budget.

This habit will reduce the number of transactions to categorize in your bookkeeping, ultimately saving you time and keeping your bank account in better shape.

Habit 2: The Weekly Bookkeeping Check-In

Similar to tidying up your house on a weekly basis, you should set aside time each Friday (or every other Friday) for a weekly bookkeeping check-in. Spend 30 minutes categorizing your transactions from the week and run financial reports. Analyze your spending patterns and income, identifying areas where you can cut back or increase revenue.

I promise, this exercise can be fun! Eat some chocolate, and your brain will get all the happy vibes while you’re doing it!

Habit 3: Monthly Credit Card Management

Paying off your credit card every month should be a top priority. If you don’t, you risk accumulating unnecessary interest expenses that you could do without. And chances are, if you’re constantly carrying a balance, you may be spending more than you earn.

Get into the habit of paying your credit card on the 1st and 15th of every month. If you really can’t afford to do that, review your profit numbers during your weekly check-ins to see if you can allocate extra funds for a tad more aggressive debt payoff.

And since we’re cruising with the household analogy, paying off your credit card is like decluttering that junk drawer in your kitchen. If you can focus on it for half a second and get it systemized, it’s easier to keep under control moving forward.

Habit 4: Quarterly Review

The quarterly review is a more in-depth version of the weekly check-in. We’re looking back and looking forward!

Look back at the previous quarter to understand your revenue and expenses. Did you hit your revenue goals? If not, pull up your marketing analytics to see if there’s an explanation as to why. Did you do better than you thought you would? If so, what contributed to the higher revenue?

Then look at your expenses. What were your highest expenses? Were they necessary? What was the ROI for each one? Is there anywhere that you can possibly cut back, even if it’s just for a few months to improve your profit, if that’s what you need?

After evaluating the past, take some time to look into the future.

Do some back of the napkin calculations for projected revenue (based on the contracts currently signed) and add them to a basic spreadsheet. Then do the same thing with your expenses to check in with your monthly recurring payments and also add in any one-off expenses or annual subscription payments coming up, too.

You should have a pretty good picture of how the next three months of your life will shape up after this exercise every three quarters.

Bonus habit to cultivate quarterly: pay your quarterly estimated tax payments! I highly recommend working with a CPA to help you determine what this amount should be based on all the things going on in your life, NOT just your business!

Habit 5: Annual Deep Clean

Once a year, you’ve got to file your tax return and create an annual budget. These are two things that are non-negotiable for every successful business owner.

This’ll feel a lot like crossing off those house things that need to happen once a year (but I can’t think of any because my husband does all of them haha) (omg can you tell that analogies feel so dorky on me)

Work with a CPA to file your tax return, especially if you have a lot of moving parts – owning a business, your partner’s income, dependents, moving expenses, house expenses, etc.

Yes, we can all use that one giant tax filing software to get this done ourselves, but working with a professional will not only support a small business owner, but will give you the care and attention that you and your business deserve!

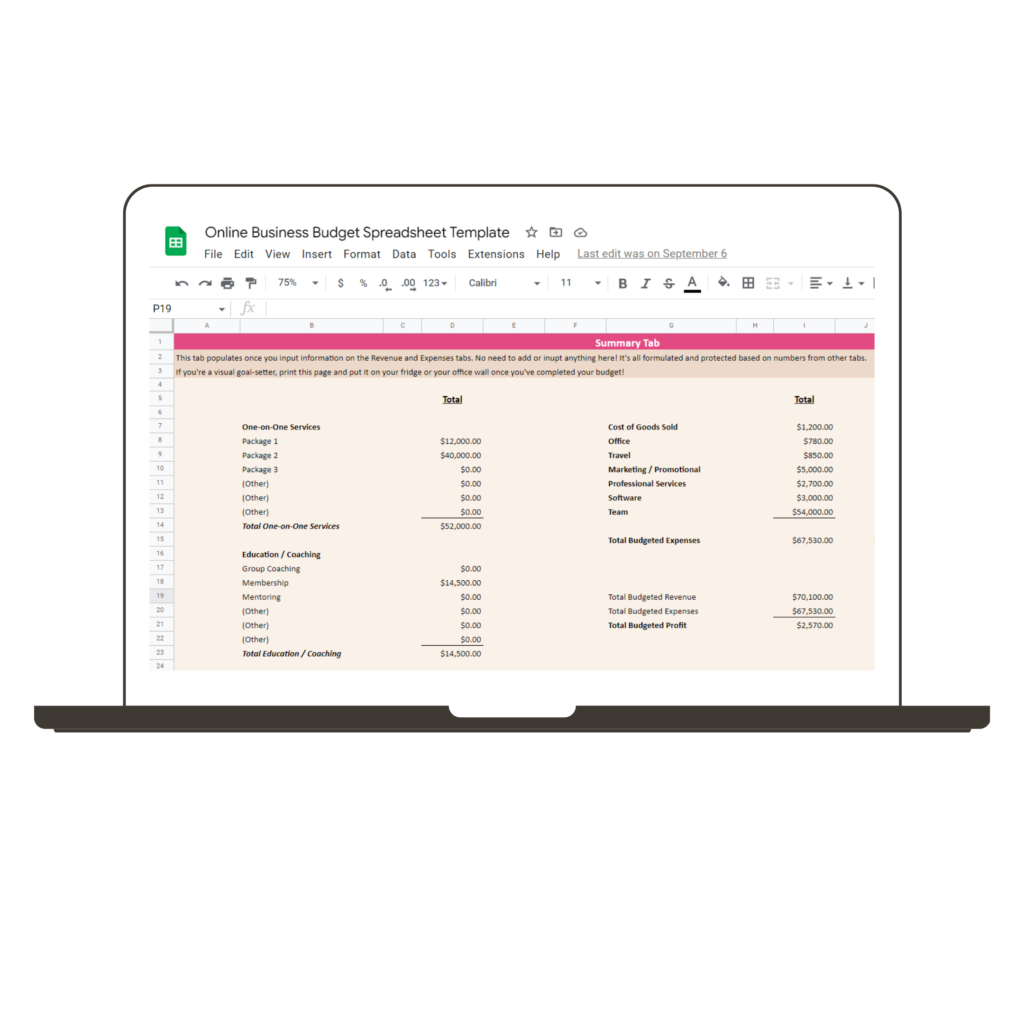

If you don’t know how to create a budget for your business, I’ve got the perfect spreadsheet template for you that is suuuuper easy to use. It’ll show you exactly how to map out all of your revenue goals for the year, take into account every single expense you plan to pay in each month and how that affects what you pay yourself and what you save for taxes.

I’ve had people use this template who absolutely hate spreadsheets and they have told me how easy it is to implement! It even comes with a video showing you exactly how to implement it for yourself.

If you want a more customized done with you option, we also offer VIP Budget Days at Madison Dearly Bookkeeping. This is like a deep tissue massage, y’all.

We will spend 3 hours together mapping out every single wish list item you want for your business, then back into your sales goals numbers and even make sure that all the numbers work together to be paying you what you want to take home, while also saving for taxes.

I LOVE THESE CALLS. If you have any questions, drop them in the comments or send me a DM on Instagram and we can chat about if this is right for you!

Want to outsource some of these habits?

While it’s best practice to get into the habit of doing these tasks yourself, you actually can outsource a few of them!

If you don’t want to do your books for 30 minutes every week, we got your back! Click this link to apply to work with us! We’ll knock out your bookkeeping FOR YOU and drop pretty little (easy to understand) reports in your inbox every month!

Quarterly calls are included with our Essentials package, so you know you can easily cross that off your list after our call every three months!

Check out the details for our VIP Budget Days here and sign up for our email list here to get notified when spots are available! (They fill up SO FAST every year!)

Whether you outsource or get super strong with these habits, you’re on the right path and you’re doing great, friend!

Leave a Reply Cancel reply

Join The Monthly Book(keeping) Club

If you’re doing your bookkeeping yourself... AND PUTTING IT OFF for months at a time

JOIN THE CLUB

A done-with-you monthly bookkeeping membership for the online business owner who wants to learn how to do their business bookkeeping and actually get it done each month.

SITE CREDIT

Terms and Conditions

Privacy Policy

Want my best business finance tips delivered straight to your inbox? Join my email list here!

SUBSCRIBE

Madison Dearly Financial is the only comprehensive accounting firm exclusively serving creative small businesses.

Bookkeeping & Tax Services for CREATIVE PROFESSIONALS

PHOTOGRAPHY

Madison Dearly Financial is an independent firm and is not affiliated with, endorsed by, or officially associated with any accounting software platforms such as Xero, QuickBooks, or Gusto. All trademarks belong to their respective owners.

Pricing Note: Listed prices reflect base rates. Final pricing may vary based on the scope, complexity, and timeline of the project. Payment plans may be available upon approval.

Timeline Note: Estimated timelines are based on receiving timely client responses and smooth implementation. Projects with custom needs or delays may require additional time.

Content Disclaimer: Our blog content is for educational purposes only and does not replace professional financial, legal, or tax advice. We aim to keep information current and helpful—please consult a licensed expert before making decisions based on this content.

Paragraph

Paragraph

Home

About

Work With Us

Template Shop

Membership

Blog

Resources

Contact

Go ahead—

check us out!

We're an open book.