Meet Madison Dearly

We offer top notch bookkeeping for brand and web designers who think big. Most importantly, we're here to make your numbers accessible and understandable. Curious about working with us? Come take a peek!

5 Ways Better Bookkeeping Can SAVE You Money

DOWNLOAD NOW

How to Create a Business Budget for Your Online Business

November 15, 2022

Many of us have a personal household budget, but do you also have a budget for your business? We tend to forget that – just like with our luxury spending habits – our business spending habits should be tracked and approved to make sure that your business is optimized for profitability over time!

It’s easy to check the balance of our bank account, a little more complicated to analyze if we can actually afford a big investment in our business, but when it comes to overarching sales goals and making sure your business is still alive and breathing next year, a business budget is how we can make sure we are covering all of our wish list expenses!

So without further ado, here is my three-step process to creating a business budget in an effective way to expand your profitability and give you a great financial goal plan for next year!

Start with your bookkeeping!

I mean… Did you expect anything else from my first bullet point?

It is ridiculously difficult to get anything done in your business (hiring a team member, joining a mastermind, investing in new equipment, etc.) without first doing your bookkeeping. Budgeting is no different! Make sure you’re completely caught up year-to-date (meaning January 1st until the date that you’re reading this blog) with your bookkeeping before moving to the next step! We’ll be using that Profit & Loss to create an input template, and we’ll also reference it to forecast our expenses for the next year!

- If you need a DIY bookkeeping spreadsheet template, check out my favorite one to shout from the rooftops here!

- If you are ready to take yourself OUT of spreadsheets and into a software that will grow with you over time, I highly recommend starting with Xero at their $12 per month plan. (It’s the best software for non-bookkeepers and non-accountants – trust me!)

- If you’re ready to hire a bookkeeper, check out my services here!

Pull your Profit & Loss Report

It’s the BEST template to build on!

In this step, we are going to use those tidy books to create a shell template to build out next year’s business budget! I’ll teach you how to walk through it two ways: if you’re using accounting software or if you’re using a spreadsheet!

Software

The first thing you’ll start with is pulling your Profit & Loss Report BY MONTH. (It may also be called an Income Statement.) We want to make sure that this P&L gives us a month-by-month view so we can accurately enter data in the month that we expect to see it happen. Export that report to Excel and save it on your computer. (You can even put it into Google Sheets if you’re more familiar with that platform.)

Once you’ve got your P&L, remove all of the data from this year and rename the dates with next year (i.e. 2022 to 2023). Check to make sure each line item has a zero value for each month, and also that the formulas are working correctly! (Some accounting software reports will automatically export with sum formulas for rows and columns.)

Spreadsheet

If you’re using a spreadsheet, find the highest-level picture you can get with month-over-month data. If you don’t have that type of information readily available (like you might just have revenue and expenses spread out in different tabs for each month), then I would suggest you start a brand new spreadsheet for your budget and reference your current-year numbers as you’re building it out!

In this blank spreadsheet, you’ll need a column for each month of the coming year, and a row for each revenue stream and each expense category you have. Then sum the totals for each line item and for each month (each row and each column).

Don’t want to make your own business budget spreadsheet? We have one for you here!

Start with expenses, then move to revenue!

Let’s make those wish list dreams come true!

Now the fun part! Once you’ve got your blank shell, start by inputting all of your expenses for the coming year. Make sure to take these extra items into consideration:

- Any new monthly expenses that aren’t currently on your Profit & Loss that you are expecting to incur in the new year

- Current team member pay increases

- New team members

- Business trips (food, hotel, rental car or ride sharing, plane tickets, etc.)

- Office expenses (a small spending spree 2-4 times per year for highlighters, pens, notebooks, paper planners, printer paper, etc.)

- Software subscriptions (List them ALL out so you can make sure each of them are still serving your business, and cut ANY that you don’t use anymore.)

- Training & Education (courses, group coaching programs, a business coach, a mastermind, etc.)

Once you have all of your expenses listed out BY MONTH, take some time to evaluate what that means for your sales goals.

How much do you need to make to cover all of those expenses and still pay yourself with an Owner’s Draw or salary? To still keep a percentage in your business as savings for taking time off? Or to save the right amount for taxes this year instead of getting hit with an unexpected bill from the IRS during tax time?

If you are using Profit First, take your “Operating Expenses” percentage and back into your Total Income (revenue) number. For example, if your transfer percentage to your OpEx account is 30%, and your total expenses for the year are $30,000, your target revenue number is $100,000. This is a super helpful way to easily go from your total expenses number to your total sales goal number, while still allowing for Owner’s Pay and Tax savings!

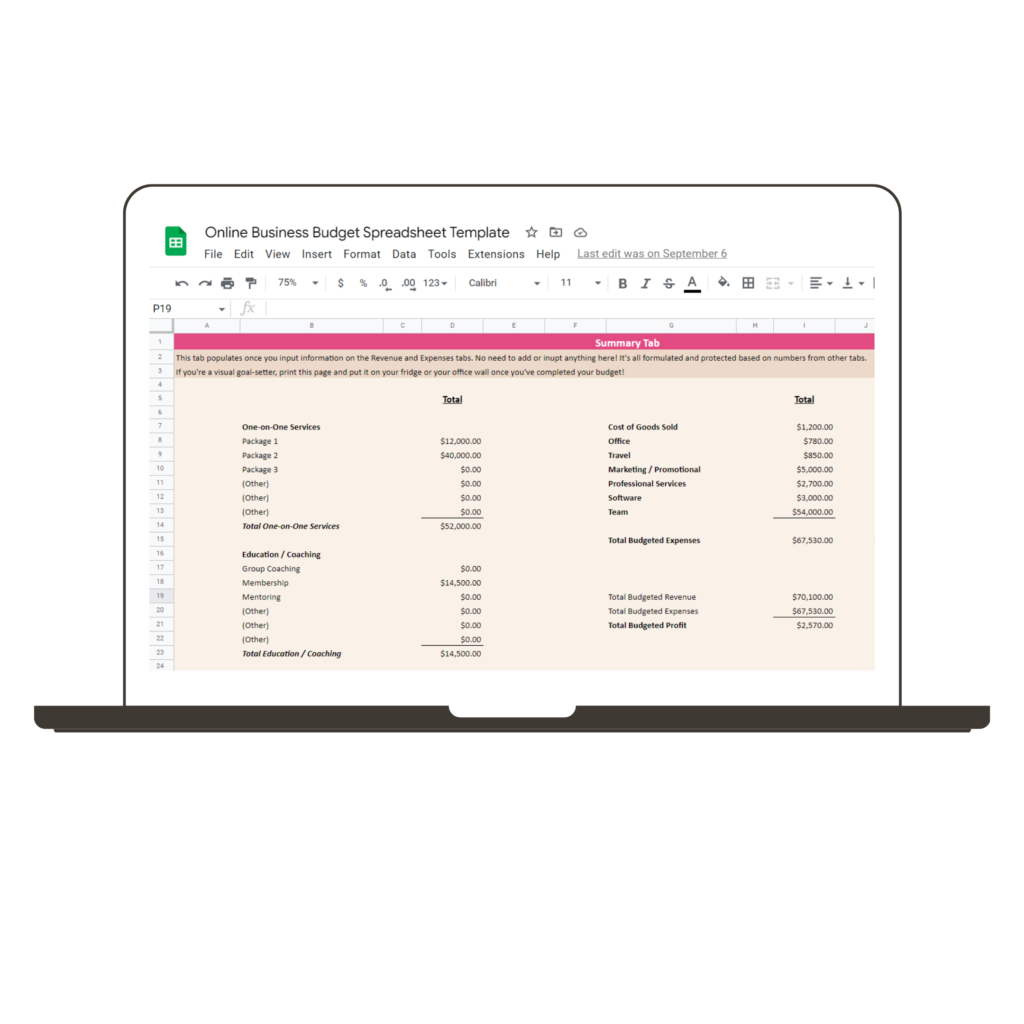

Grab our online business budget spreadsheet — it’s ready to fill in!

If you’re like most entrepreneurs and business owners I know, you’re not exactly a lover of spreadsheets or numbers. Even if you’re comfortable with your numbers, tracking them and figuring out things like formulas, conditional formatting, and all that is just… too much.

You’re busy — and you want to budget. What’s a business owner to do? Grab our NEW Online Business Budgeting Spreadsheet.

The entire spreadsheet is broken down by month, so we can clearly map out what your revenue and expenses are for each month throughout the year. This helps tremendously when it comes to planning launches, taking time off in your business, and adding extra expenses into months where revenue is higher to keep your profitability in check!

This budgeting spreadsheet is easy to understand, and SIMPLE. Because who else needs a complicated, “Is this SUM formula working right?!” type of spreadsheet in their lives? Not you.

I’ve even included a mini-training walkthrough video to show you EXACTLY how to use the spreadsheet, so there’s no guessing on how to use this thang to its full potential.

Want to see the spreadsheet in action? Check it out here.

Leave a Reply Cancel reply

Join The Monthly Book(keeping) Club

If you’re doing your bookkeeping yourself... AND PUTTING IT OFF for months at a time

JOIN THE CLUB

A done-with-you monthly bookkeeping membership for the online business owner who wants to learn how to do their business bookkeeping and actually get it done each month.

SITE CREDIT

Terms and Conditions

Privacy Policy

Want my best business finance tips delivered straight to your inbox? Join my email list here!

SUBSCRIBE

Madison Dearly Financial is the only comprehensive accounting firm exclusively serving creative small businesses.

Bookkeeping & Tax Services for CREATIVE PROFESSIONALS

PHOTOGRAPHY

Madison Dearly Financial is an independent firm and is not affiliated with, endorsed by, or officially associated with any accounting software platforms such as Xero, QuickBooks, or Gusto. All trademarks belong to their respective owners.

Pricing Note: Listed prices reflect base rates. Final pricing may vary based on the scope, complexity, and timeline of the project. Payment plans may be available upon approval.

Timeline Note: Estimated timelines are based on receiving timely client responses and smooth implementation. Projects with custom needs or delays may require additional time.

Content Disclaimer: Our blog content is for educational purposes only and does not replace professional financial, legal, or tax advice. We aim to keep information current and helpful—please consult a licensed expert before making decisions based on this content.

Paragraph

Paragraph

Home

About

Work With Us

Template Shop

Membership

Blog

Resources

Contact

Go ahead—

check us out!

We're an open book.

[…] I hope that you have a solid budget and a plan for making it all happen. If you don’t, I have a business budgeting guide here for you […]

[…] Read my business budgeting guide here. […]

[…] you groan and exit out of this window, hear me out. A business budget isn’t the sexiest thing ever, but it can absolutely help you plan for and afford those new […]

[…] To combat this, make it a practice to sleep on potential purchases for 24 hours. Talk about it with a trusted friend (or me, your bookkeeping big sis), and check your budget. […]