Meet Madison Dearly

We offer top notch bookkeeping for brand and web designers who think big. Most importantly, we're here to make your numbers accessible and understandable. Curious about working with us? Come take a peek!

5 Ways Better Bookkeeping Can SAVE You Money

DOWNLOAD NOW

How Many Bank Accounts Does Your Online Business Need?

January 16, 2023

Banking. It’s probably not the first (or most fun) thing you think about when growing your online business. Money comes in, money goes out. As long as you’re “in the black,” you’re good, right?

While that’s true — you want to be profitable! — there are also a few ways banking can help you grow faster, save more money, and pay yourself more. If you want to really improve your finances, the first step might be in…

Opening more bank accounts for your online business. Let me explain.

First: You need separate business and personal accounts

One of the biggest things I see online business owners do is manage their business income and expenses through personal accounts.

I know it seems pointless to have a business checking or savings account when it’s just you getting paid. The money is coming in and going out through your checking account, and it all works. Until it doesn’t.

It can be really hard to remember if that Amazon charge was for the new keyboard you need to do your work or for your nephew’s birthday party. And if you get audited (knock on wood), you’ll have a really hard time working with the IRS to prove what’s business-related and what’s not.

Take away the fear of taxes and it’s also just so much easier to separate out your personal and business finances. One time, I spoke with a woman in a mastermind group we were in about splitting her personal and business accounts. She didn’t think it was that big of a priority, but she finally did it — and couldn’t believe how much more clarity she had around her business finances. She DM-ed me later telling me she wished she had done it way sooner.

A simple thing like opening an online business account can change the way you see your business.

Don’t forget a business savings account

Already have a business checking account? That’s great. I’m proud of you! Now… You need a business savings account, even if it’s just for tax savings. Depending on your tax status (married, single, income, etc.), you will have to save anywhere from 15 to 30% of your business net income, or what’s left after expenses.

It helps immensely to have this money pulled out of your operating account, so you don’t accidentally spend your tax savings or dip into it to invest in your business. The tax man has to get paid, and a savings account will help separate funds so you don’t come up short when your quarterly tax bill is due.

(Note: This suggestion is mostly for U.S.-based business owners, but applies to Canadian and international friends, too! Just know your tax rates and tax payment schedule.)

Now… what if you’re ready to really operate your business with stronger finances? Do you need other bank accounts? Maybe!

The online business bank accounts you need, according to Profit First

Profit First is a book and a banking framework created by Mike Michalowicz. If you haven’t read his book, I really do recommend it. While it’s not perfect, I do think it explains so much of the financial side of business in ways that creatives and non-money-minded folks can appreciate.

But here’s the crash course: Profit First is a money management method. It shows business owners how to split their business revenue up so they can continue to fund operations while also putting profit first. (It’s kind of all in the name.) Essentially, this ensures that you take a portion of every dollar you make and put it into your profit account, so you have money left over to continue to grow or to keep your business afloat if you take leave.

Profit First “buckets”

With Profit First, envision that you have a “bucket of money” — all the money you have in the business. With Profit First, you take a percentage out of that big bucket and move it into 5 categories (or 5 accounts):

- One account for income (this is usually the main checking account, where invoices get deposited))

- One account for expenses (where contractor, software, and other payments are withdrawn)

- One account for owner’s pay (a percentage of income moves here, then you withdraw money into your personal accounts)

- One account for tax saving (a percentage of income moves here and you pay taxes from this account)

- One account for profit (a percentage of income moves here, to be saved for future projects or investments as well as “rainy days”)

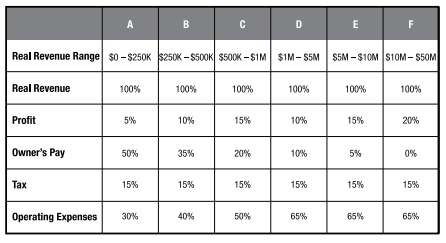

To know what each account should hold, you assign percentages to each one. This will vary depending on what you want your business to look like, i.e. how much you want to pay yourself, big investments you want to save for, and so on.

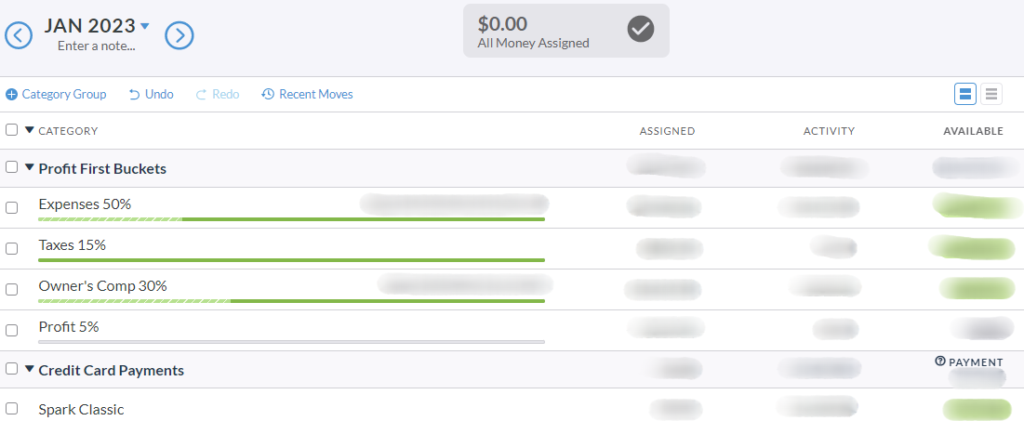

For me, my Profit First “percentages” are:

- 50% operating expenses

- 30% owners pay

- 15% tax saving

- 5% profit

Some business owners may be single with higher income, so they need to increase their tax savings to 25%, while others may want to up their profit margins to 20% to save for future investments. The percentages are up to you, but Mike shares recommended percentages in the book Profit First.

How to easily split money between business bank accounts

I know you might think, “I’ve barely opened my business checking account… now you want me to open 4 more??” Don’t panic — I’m not saying you have to have five accounts if you don’t want them.

Some people prefer to have separate bank accounts so they can actually transfer the money between accounts. There’s something in seeing the dollars move between account balances. For others, though, simply knowing how much you have in a “fund” that’s housed in a single account might work.

As I mentioned before, you want at least a business checking account and a business savings account. But when it comes time to calculate how much to transfer to your other accounts, how do you figure that out?

Well, I don’t. Let my favorite budgeting tool do that: You Need a Budget (YNAB). With YNAB, I get a notification that says there is “money to assign,” and then when I sort it, it tells me exactly how much money is in each “fund.” I don’t have individual accounts for each of my funds, but I do see the total funds allocated for each purpose easily in YNAB.

Again, how you split up your money is up to you. Open 5 business accounts if you want, or just keep track of how money is allocated to each fund. The goal here is clarity. We want you to see what you have coming in, what you have to spend, what you have to pay taxes, what you’re paying yourself, and what you have set aside for the future.

Want to manage your business finances better?

When business owners come to us, it’s because they’re ready to really make the most out of the money coming in. Whether you’re setting up a business account for this first time or you’re opening your fifth one to follow Profit First, you’re on the right track.

If you want a better understanding of how to budget your business finances or how much to allocate to which of your funds, I can help!

Read my business budgeting guide here.

Leave a Reply Cancel reply

Join The Monthly Book(keeping) Club

If you’re doing your bookkeeping yourself... AND PUTTING IT OFF for months at a time

JOIN THE CLUB

A done-with-you monthly bookkeeping membership for the online business owner who wants to learn how to do their business bookkeeping and actually get it done each month.

SITE CREDIT

Terms and Conditions

Privacy Policy

Want my best business finance tips delivered straight to your inbox? Join my email list here!

SUBSCRIBE

Madison Dearly Financial is the only comprehensive accounting firm exclusively serving creative small businesses.

Bookkeeping & Tax Services for CREATIVE PROFESSIONALS

PHOTOGRAPHY

Madison Dearly Financial is an independent firm and is not affiliated with, endorsed by, or officially associated with any accounting software platforms such as Xero, QuickBooks, or Gusto. All trademarks belong to their respective owners.

Pricing Note: Listed prices reflect base rates. Final pricing may vary based on the scope, complexity, and timeline of the project. Payment plans may be available upon approval.

Timeline Note: Estimated timelines are based on receiving timely client responses and smooth implementation. Projects with custom needs or delays may require additional time.

Content Disclaimer: Our blog content is for educational purposes only and does not replace professional financial, legal, or tax advice. We aim to keep information current and helpful—please consult a licensed expert before making decisions based on this content.

Paragraph

Paragraph

Home

About

Work With Us

Template Shop

Membership

Blog

Resources

Contact

Go ahead—

check us out!

We're an open book.

[…] really looking at the “supplemental cash” that you have as a cushion in your bank account. Not your tax savings account, not money you’re supposed to pay yourself with. Extra cash on […]

[…] to think about their books. They don’t want to think about what’s coming in or going out, or do calculations to find out how much to save for taxes or future business […]

[…] You’re sorting through income you’ve received, expenses you’ve paid, outstanding invoices, and money saved for things like taxes or owner draws. […]

[…] Make it easier to calculate profit by creating additional bank accounts: one for operating expenses, one for taxes, and more. Find out why these bank accounts are a smart move here. […]

[…] (and by up to date, I mean January 1 until today!) Make sure you have every transaction from your bank account(s) organized by type — income, contract labor, professional dues, expenses, […]